The Rise of the Electrostate

For much of the past decade, the energy transition has been framed primarily as a political or environmental project defined by policy targets, subsidies, and climate negotiations. That framing is becoming obsolete.

A quieter but more durable shift is underway: the transition is increasingly driven by system economics and industrial scale, underpinned by demands for energy sovereignty. The clearest evidence of this change emerged last year in the world’s largest and fastest-growing energy systems - China and India.

In these countries, we are witnessing the birth of the Electrostate: a new type of economy that treats energy as a manufactured rather than an extracted commodity. What distinguishes this phase is not that fossil fuels are disappearing, but that the long-standing link between economic growth and fossil fuel growth is weakening.

1. The Great Decoupling: China’s Structural Shift

For two centuries, the blueprint for national prosperity followed a rigid, carbon-heavy path: to industrialize, a nation had to burn an exponentially increasing amount of coal and oil. But as we enter 2026, China demonstrates that this model may be obsolete.

In 2025, electricity demand in China grew by more than 5%, equivalent to roughly 520 TWh of additional consumption. Yet, for the first time in an industrializing economy, fossil fuel generation didn't just slow down; it began to shrink, falling by nearly 2% even as the economy grew.

The reason – the country added about 585 TWh of wind and solar generation, sufficient to cover the incremental electricity demand.

For two years in a row, China has now hit a milestone that many economists thought was decades away: Clean energy generation began outstripping total electricity demand growth.

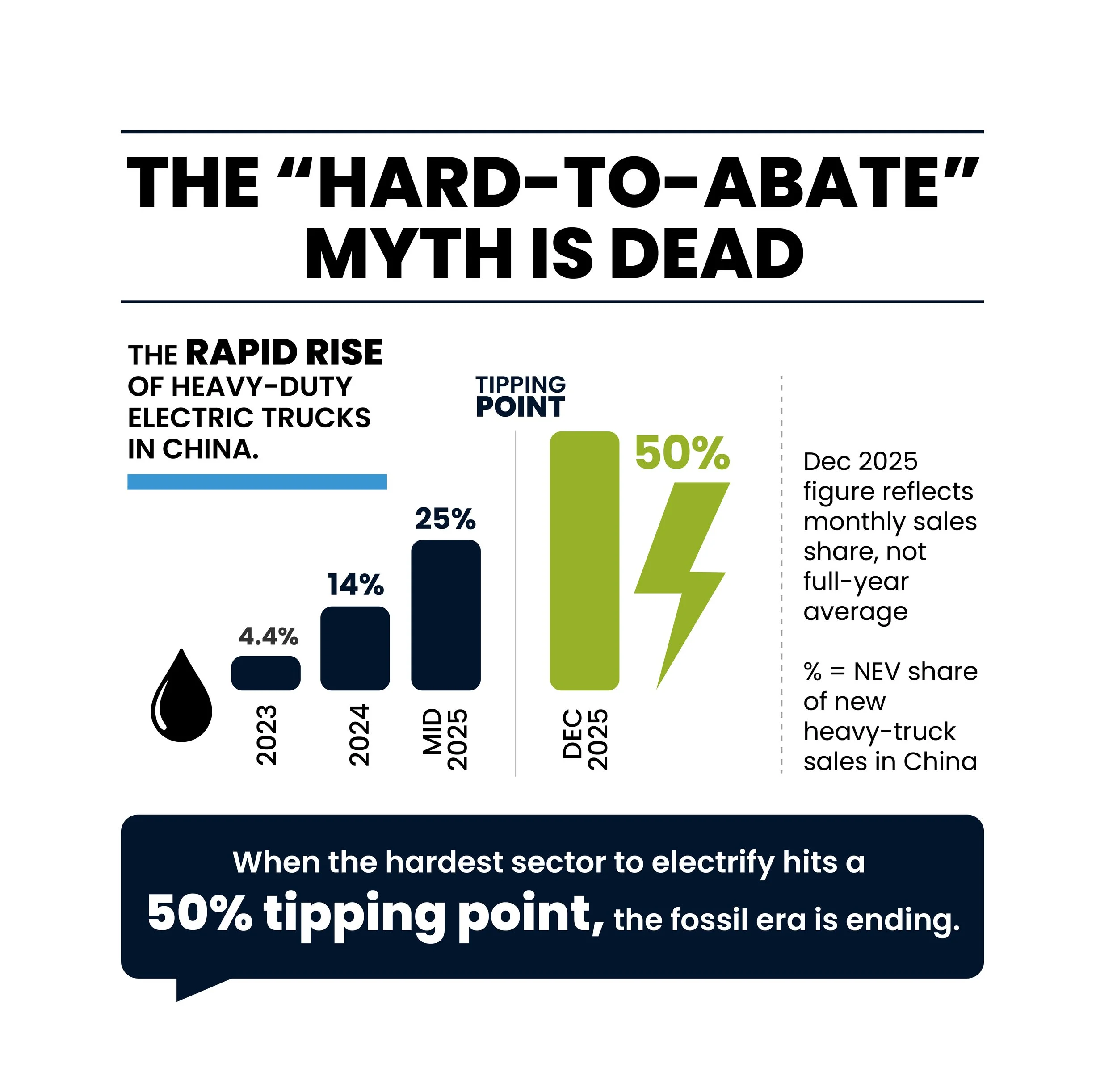

2. The Last Bastion of Fossil-based Transport: Why EV Trucks are the "Death Knell"

If the decoupling of the power grid to fossil fuels was the first act, the electrification of heavy freight may be the final nail in the coffin of traditional fuels. Heavy-duty trucking has long been considered a safe haven of diesel use - the one sector where batteries would be too heavy and charging too slow.

In December 2025, that bastion of diesel fell in China, where 54% of new heavy truck sales that month were for New Energy Vehicles (NEVs). This growth is driven by NEVs having a 10% -25% cost advantage vs. diesel, in total cost of ownership. And it was made possible through two specific industrial innovations that the west has not attempted:

Clean-Sheet Engineering: Unlike Western OEMs seeking to retrofit diesel trucks with batteries, Chinese companies designed trucks from the ground up as electric platforms, optimizing weight distribution and efficiency.

Infrastructure Leapfrogging: The slow-charging problem was solved by Battery Swapping. By early 2026, companies like CATL have deployed over 1,000 "Qiji" swapping stations, allowing a semi-truck to "refuel" in under five minutes - faster than a diesel fill-up.

When the most "difficult" sector to electrify turns away from oil because it is simply too expensive to keep burning it, the fossil growth model is reaching its dead end.

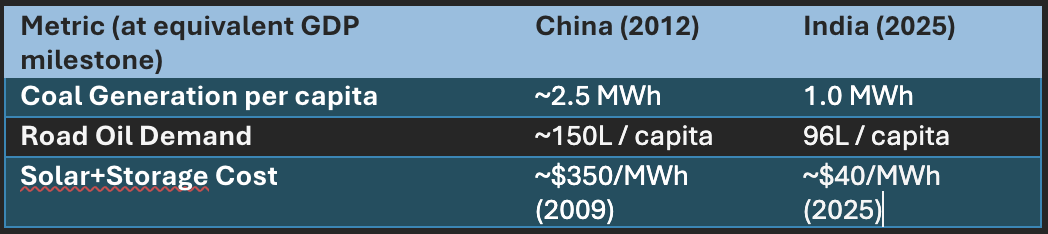

3. The Leapfrog: India’s Developmental Shortcut

India illustrates that independence from fossil fuels is possible even earlier in a country’s development.

In 2012, when China reached a GDP per capita equivalent to India’s current level ($11,000 PPP), its growth was fueled almost entirely by coal. Today, India by contrast, is industrializing with much more clean energy that is available at a fraction of the cost (the Electrotech Track).

This is possible because, for the first time in history, solar-plus-storage is cheaper than new coal. In recent 2025 auctions in Rajasthan, India, solar-plus-storage projects were awarded at roughly ₹4.28 per unit, significantly undercutting the ₹6.00 per unit average for new thermal coal.

4. The Engine: Why This is Happening Now

These developments are underpinned by a completely new technology landscape of how energy is produced.

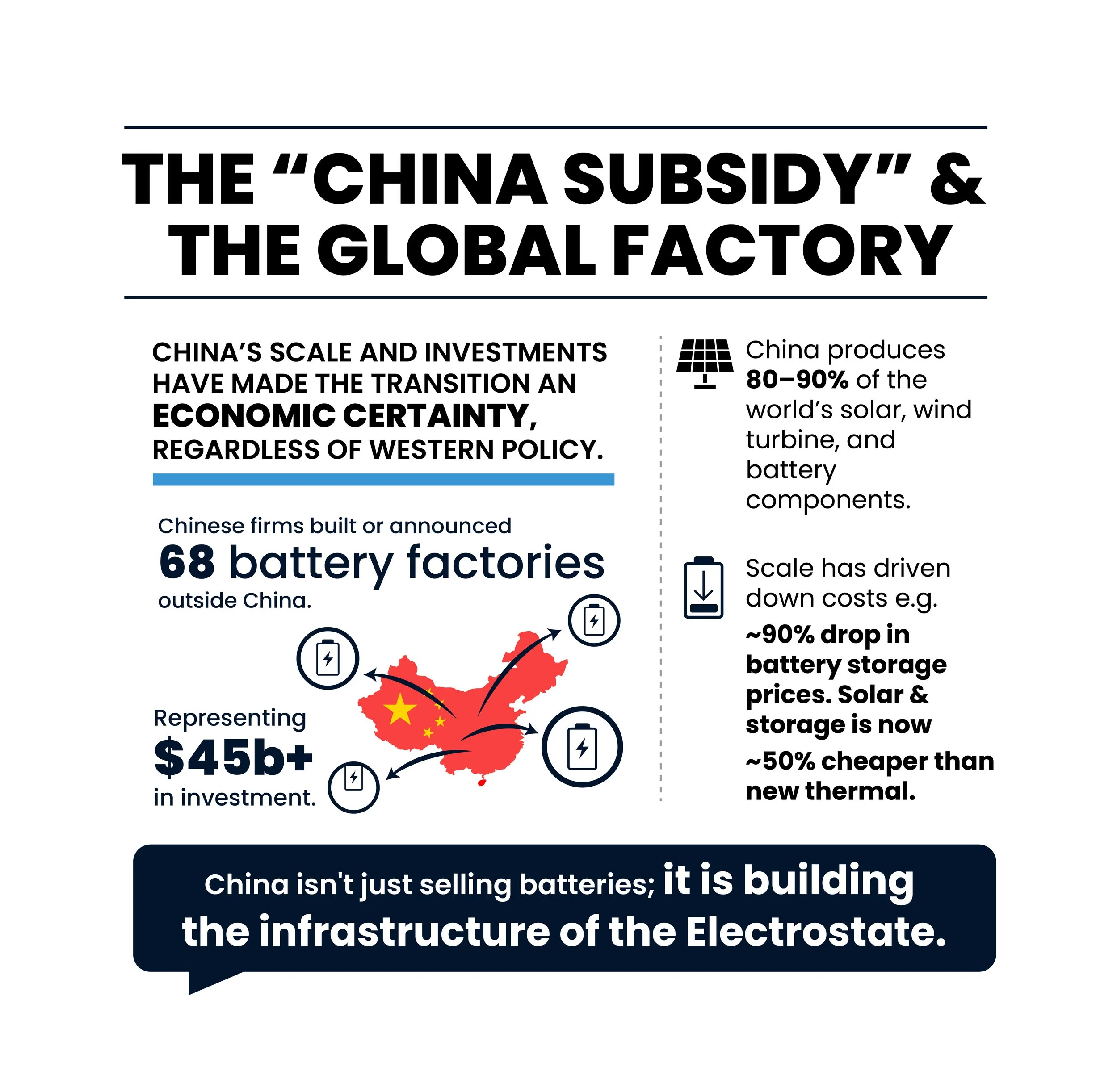

Falling technology costs: Massive scale in China has made clean energy the cheapest way to build a power grid and transportation network from scratch, with solar+storage 50% cheaper than new thermal. As total cost of ownership flips and clean supply becomes the least-cost way to expand energy services, deployment accelerates even without policy support.

The New R&D and Manufacturing Map: But this is not just a "Made in China" story. Chinese firms are now investing more abroad than at home. In 2024-2025, they built or announced at least 68 battery factories outside China, representing over $45 billion in investment. These earn a higher margin abroad (29%) compared to 23% domestically. These aren't just assembly lines; they are the new "refineries" of the 21st century.

The "China Subsidy": By scaling production to unprecedented levels, first for its own use, China has effectively "subsidized" the rest of the world’s transition. It currently produces 80-90% of the world's solar, wind turbine, and battery components. Technology that was once a luxury is now a commodity, controlled by one electrostate.

European debate on the cost of the energy transition misses the point and is a symptom of incumbency bias. We look at the "cost" of replacing existing assets (gas boilers, ICE factories, coal plants) and see a burden. The Electrostate looks at the "cost" of building new assets and sees a competitive advantage.

Conclusion: The New Industrial Reality

We have moved from an era of energy extraction to an era of energy manufacturing.

The implication is not a smooth or immediate decline in fossil fuel use. However, economic growth no longer guarantees fossil-fuel growth, as countries now have a new blueprint for development. For a country like India, which historically spent 5% of its GDP on fossil fuel imports, every gigawatt of solar is a permanent macro-economic stimulus. It converts a recurring import expense into a one-time infrastructure investment.

This other "Energy Transition" is increasingly driven by cost competitiveness and industrial scale far removed from points of consumption. And it is not a future projection nor a moral crusade. It is a present-day industrial reality and a race for industrial survival that gives the future engines of the global economy a substantial advantage. China’s 20-year lead in battery research is the modern equivalent of discovering the North Sea oil reserves.

The nations that win the next decade will not be those that "balance" their transition with fossil fuels to appease legacy sectors. They will be the ones that recognize that energy is now a manufactured commodity.

While Western discourse is often focused on the cost of Net Zero, the rest of the world is using electrification as a shortcut to industrial supremacy. The transition hasn't just won the moral argument; it is permanently rewriting the rules of economic growth. The era of the Electrostate is beginning.