Flow Batteries Mainstreaming for Long-Duration Needs

A recent article in PV Magazine highlights the growing recognition of flow batteries' unique strengths in grid-scale storage. Unlike lithium-ion, flow batteries offer decoupled power and energy, meaning storage capacity can be increased simply by adding more electrolyte. This makes them particularly cost-effective for applications requiring several hours (or even days) of storage.

Why Haven’t Flow Batteries Taken Off at Scale—Until Now?

Flow batteries have been around for years, but never really took off. They have faced several challenges to large-scale adoption until recently:

High upfront costs: The biggest barrier has been competition from a ever falling cost curve of Li-Ion batteries; with higher upfront capex and despite promising longer life, they have been less attractive for early-stage projects.

Limited manufacturing scale: Production capacities for flow batteries have lagged behind those of lithium-ion technologies, which benefit from economies of scale driven by electric vehicle (EV) demand.

Technology maturity: Significant R&D investments were needed to improve efficiency, reliability, and to reduce maintenance costs.

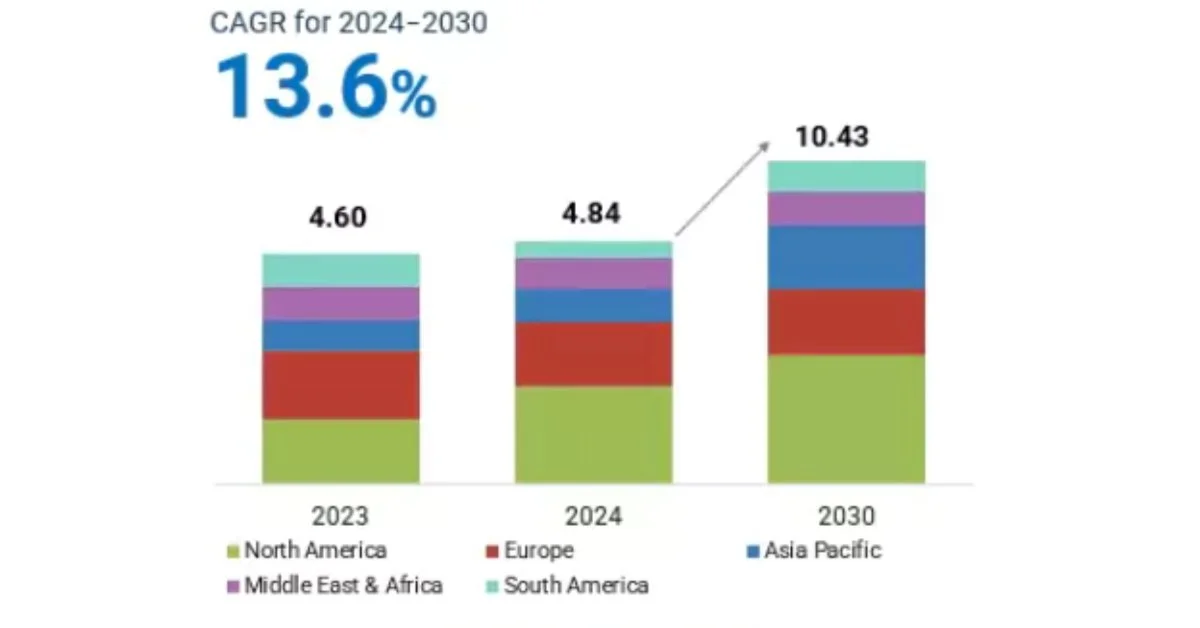

This is changing, however, and the global long-duration energy storage market is projected to grow at a CAGR of about 14% from USD 4.8bn in 2024 to USD 10.4 billion by 2030.

Several factors are today creating a more favorable environment for flow battery adoption:

1. Policy support for long-duration storage in utility applications: Governments and utilities are requiring grid reliability, which requires storage solutions capable of delivering 8+ hours of energy.

2. Netzero-driven demand from commercial and industrial (C&I) customers: Decarbonization roadmaps of energy intense industries (e.g. ports, steel and manufacturing) require long-duration energy storage and offer payback rates below 5 years.

3. Cost reductions through innovation and scale: Companies have established – or are establishing – larger assembly lines and developing innovative partnerships (e.g. Vflowtech has partnered with Reliance to source vanadium). This is driving down costs and improving performance.

As renewable energy sources like solar and wind continue to penetrate the grid and companies move to achieve netzero goals, the need for long-duration storage to smooth out intermittency becomes critical. Flow batteries step in to fill this gap, in particular for applications requiring over 10 hours of storage.

Our Perspective

Back in 2019 we recognized this trend after conducting an extensive market map of battery storagechemistries and providers – a map that we continue to refresh.

Our white paper, Utility-scale energy storage at an inflection point, underscored the importance of alternative storage technologies to lithium-ion. We highlighted including Li-Sulfur, solid-state, and flow batteries as important for the future of battery storage.

We found flow batteries as especially relevant for ulta-long duration storage, noting their potential for:

1. Separation of power and energy, allowing for flexible and cost-optimized storage capacity.

2. Cost-effectiveness at scale, offering competitive costs for long-duration deployments in utility and C&I applications.

3. Safety and longevity: with lower fire risk and with a promise of 15+ years of life.

4. Raw material availability and sustainability, with batteries utilizing abundant and easily recyclable materials.

Looking Ahead

According to our research, the market for utility-scale and C&I long-duration energy storage is poised to explode. We expect policies in emerging markets like India and China to further accelerate adoption. The flow battery market has also matured significantly with companies like Vflowtech, which sells vanadium redox flow batteries, and ESS Inc., known for its iron flow batteries, making significant strides in commercializing this technology.

We believe that alternatives to Li-ion, including flow batteries, will play an increasingly vital role in the energy transition. As the demand for long-duration storage grows, their unique characteristics will make them an indispensable tool for grid operators, utilities, and industrial customers. Anchor Group remains committed to understanding and supporting the development of this critical technology.

Deeper dive into energy storage technologies or reach out to discuss how we can hep you navigate this evolving space.